Gamifying DeFi: The Rise of Play-to-Earn Mechanics

Decentralized Finance (DeFi) has rapidly transformed the landscape of the cryptocurrency world, offering innovative solutions for users to engage in financial activities without relying on traditional banks or intermediaries. Through smart contracts and blockchain technology, DeFi enables a wide range of services, including lending, borrowing, trading, and yield farming, all while maintaining security and transparency. Its significance lies in providing a more inclusive and open financial ecosystem, offering individuals worldwide the opportunity to participate in decentralized financial activities.

As the DeFi space continues to grow, a new wave of innovation is emerging — gamification. By integrating gaming mechanics into DeFi platforms, developers are not only attracting more users but also making financial services more engaging and accessible. Gamification has proven to be an effective tool in capturing attention and increasing participation, transforming what was once seen as a complex and intimidating space into something more enjoyable and interactive.

One of the most exciting developments in this area is the rise of Play-to-Earn (P2E) models. These games allow users to earn real-world value, often in the form of cryptocurrency or NFTs, as they play. As P2E mechanics find their way into DeFi projects, they are creating a bridge between finance and entertainment, offering users the chance to earn while having fun. This blending of finance and gaming is quickly becoming a transformative force, reshaping how people view decentralized finance and paving the way for broader adoption of blockchain-based financial services.

The Basics of DeFi

What is Decentralized Finance?

DeFi refers to a financial ecosystem built on blockchain technology, where traditional financial services like lending, borrowing, trading, and investing are provided without intermediaries such as banks. Through smart contracts and decentralized protocols, DeFi enables peer-to-peer financial transactions with increased transparency, security, and efficiency.

Key Components of DeFi

DeFi platforms consist of several core elements that make up the decentralized financial system:

- Decentralized Exchanges (DEXs)

These platforms allow users to trade cryptocurrencies directly with one another, without the need for centralized authorities.

- Lending and Borrowing Protocols

DeFi lending platforms enable users to lend their assets to others in exchange for interest, while borrowing platforms allow users to take out loans without traditional credit checks.

- Yield Farming and Staking

These mechanisms allow users to earn rewards by providing liquidity or staking tokens, participating in the governance of DeFi protocols, and helping secure decentralized networks.

Traditional Challenges in DeFi

While DeFi offers numerous advantages, it also presents challenges that can hinder mass adoption:

- Accessibility

DeFi platforms require users to have technical knowledge, making it difficult for those new to cryptocurrency or blockchain to get involved.

- Complexity

The intricacies of DeFi protocols, smart contracts, and wallets can be overwhelming, especially for non-experts.

- User Engagement

Although many DeFi platforms offer promising financial opportunities, the lack of engaging, user-friendly experiences can result in low retention rates and limited participation.

The Rise of Play-to-Earn in DeFi

Introduction to P2E Mechanics in Gaming

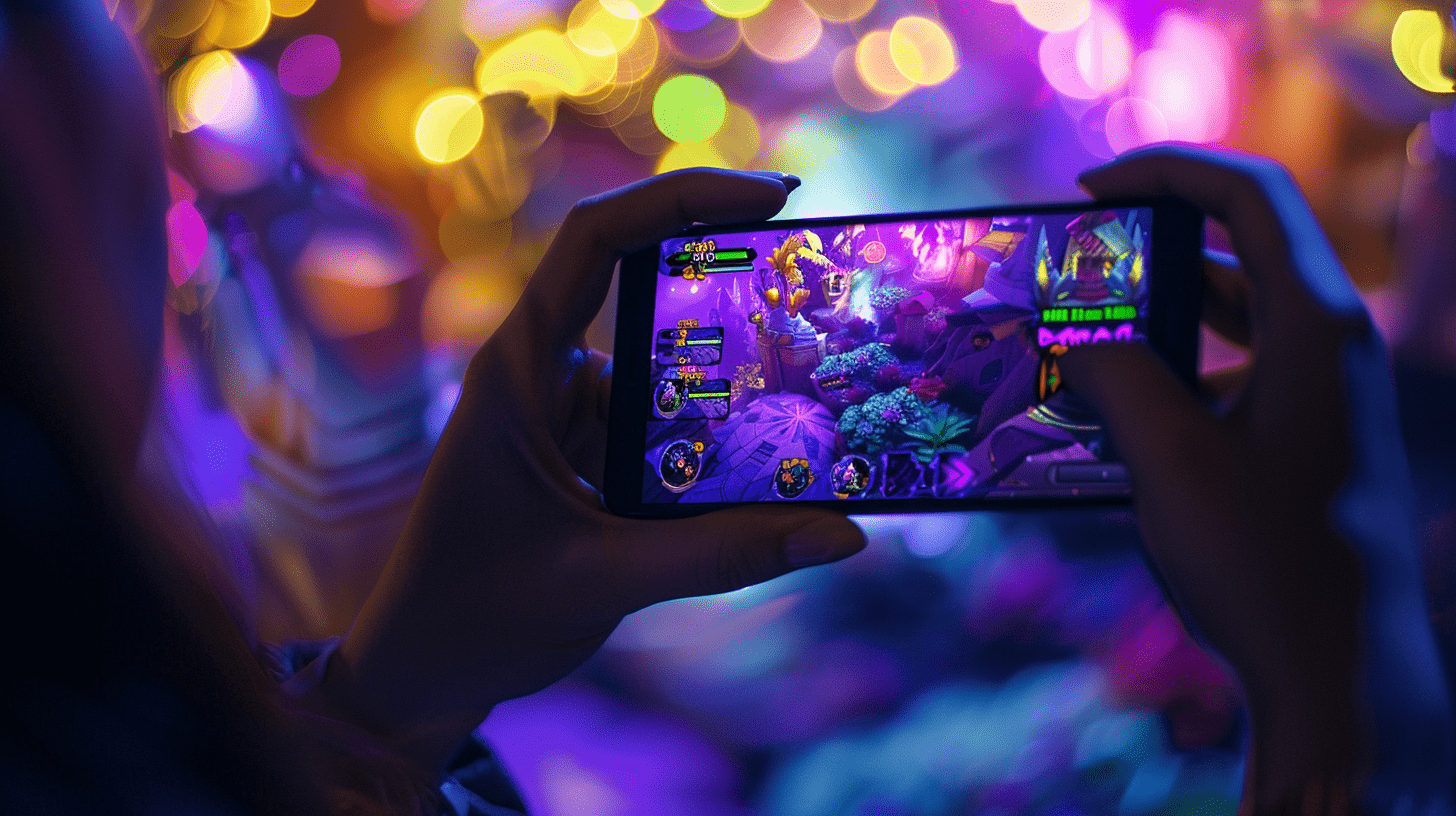

P2E is a revolutionary concept that allows players to earn real-world value through their in-game actions. Unlike traditional gaming, where players invest time and money without tangible rewards, P2E enables gamers to receive cryptocurrency or NFTs as compensation for completing tasks, achieving milestones, or engaging with the game ecosystem. These rewards can then be traded, sold, or reinvested, creating a new economy within the gaming world.

Why DeFi is Increasingly Adopting P2E Mechanics

The DeFi space, known for its financial innovation, has begun to incorporate P2E mechanics as a way to create more engaging, rewarding experiences for users. DeFi’s core goal of decentralization aligns with P2E’s vision of giving users control over their assets and rewards. By integrating P2E elements, DeFi platforms can offer users an innovative way to interact with decentralized finance, combining entertainment with financial opportunities. As more DeFi projects embrace gamification, P2E models are becoming an essential tool to attract users and increase platform engagement.

Benefits for Users: Earning Passive Income, Engaging with Decentralized Platforms

The integration of P2E mechanics into DeFi provides a unique set of benefits for users:

- Earning Passive Income

Users can earn rewards in the form of cryptocurrencies or NFTs simply by participating in games, staking assets, or completing specific in-game tasks. This creates an additional income stream while engaging in decentralized finance activities.

- Engaging with Decentralized Platforms

Through P2E mechanics, users can actively engage with decentralized platforms, contributing to the ecosystem while enjoying the rewards. This engagement deepens users' involvement with the DeFi space, fostering a sense of community and long-term participation. Moreover, it reduces the reliance on centralized authorities, empowering users to take control of their financial future while having fun.

How Gamification Enhances DeFi

Engaging Users Through Gaming-like Mechanics (e.g., Staking, Yield Farming, NFTs)

Gamification introduces gaming-inspired elements such as staking, yield farming, and NFTs to DeFi platforms, making them more interactive and engaging.

-

Staking allows users to lock their assets in a platform to earn rewards, resembling the concept of "leveling up" or accumulating points in a game.

-

Yield farming encourages users to provide liquidity to decentralized exchanges in exchange for rewards, much like earning in-game currency or items through effort.

-

NFTs have become digital assets that users can collect, trade, or sell, offering a gamified approach to asset ownership and investment within DeFi. These elements create an interactive, reward-driven experience that enhances user involvement and incentivizes active participation.

Incentivizing Participation with Rewards and Progress Systems

Similar to leveling up in a game, DeFi platforms have introduced reward systems and progress mechanisms that keep users motivated.

-

Reward structures encourage users to keep participating by offering lucrative incentives such as staking rewards, interest from liquidity pools, and exclusive NFTs.

-

Progression systems such as tiered levels or achievement badges can track users’ progress, offering recognition and further rewards as they engage more deeply with the platform. This builds loyalty and encourages long-term involvement, similar to how achievements or rankings work in video games.

Making DeFi More Accessible and User-friendly Through Gamified Elements

DeFi can often be complex and intimidating for new users. By integrating gamified elements, DeFi platforms lower the entry barrier and make the ecosystem more approachable.

-

Simple user interfaces, interactive tutorials, and step-by-step guides simplify complex tasks like staking or yield farming, transforming them into easily understandable activities.

-

Gamified onboarding introduces new users to DeFi by guiding them through tasks in a game-like format, enhancing engagement and building familiarity with decentralized tools. This makes DeFi more accessible for users who might otherwise shy away from traditional finance platforms due to complexity.

Popular P2E DeFi Projects

Notable DeFi Projects Incorporating P2E Mechanics

Several innovative DeFi projects have successfully integrated P2E mechanics, transforming the landscape of decentralized finance. Here are some notable examples:

- Aavegotchi

Aavegotchi is a unique combination of DeFi and NFTs, where players collect and trade digital ghosts (Aavegotchis) that are backed by staked Aave tokens. Each Aavegotchi has different attributes influenced by the tokens staked in the platform. Users earn rewards by participating in the ecosystem, and the project’s mechanics combine DeFi principles (staking, liquidity provision) with the fun of collecting and interacting with NFTs.

Integration of DeFi:

Aavegotchi utilizes staking as the core mechanism to generate value for both the user’s NFT and their Aave token holdings. Stakers can participate in governance, enhancing user control over the platform while earning rewards for their contributions.

- Yield Guild Games (YGG)

Yield Guild Games is a decentralized autonomous organization (DAO) that invests in Play-to-Earn games and the metaverse. YGG enables users to earn passive income by participating in gaming ecosystems and DeFi protocols. They focus on play-to-earn games that offer tokens and NFTs, which are then staked or sold for profit.

Integration of DeFi:

YGG acts as a hub for DeFi-enabled play-to-earn opportunities, allowing players to earn tokens while interacting with DeFi protocols. This model bridges the gap between gaming and decentralized finance by allowing players to stake earned tokens or participate in liquidity pools, ultimately incentivizing participation and value creation.

Case Studies: How These Projects Integrate DeFi Principles with P2E

- Aavegotchi

Aavegotchi’s gamified staking mechanism is a prime example of integrating P2E with DeFi. Users stake Aave tokens, which back their Aavegotchis, and in return, they earn rewards in the form of more Aavegotchi tokens. The platform employs a decentralized economy where users control the rarity, traits, and performance of their Aavegotchis, making it a highly interactive and profitable venture for gamers.

Key Takeaway:

Aavegotchi makes use of DeFi tools (staking, yield farming) while creating a fun, engaging environment for users to earn and grow their investments. This fusion increases adoption and retention within the DeFi space.

- Yield Guild Games (YGG)

YGG's innovative business model integrates both DeFi and P2E mechanics by allowing users to rent gaming assets (such as NFTs) to earn a share of the profits. Through the DAO structure, users can pool resources to invest in high-value gaming assets and participate in governance. Players can take advantage of the platform’s DeFi tools to stake their earnings, gain rewards, and enhance their passive income.

Key Takeaway:

YGG demonstrates how a DAO can create a seamless integration of gaming and decentralized finance, allowing users to both earn from playing games and engage with the wider DeFi ecosystem for additional gains.

These case studies highlight the versatility of P2E mechanics in DeFi, offering a tangible path for users to monetize their activities while contributing to the growth and sustainability of decentralized ecosystems.

Potential Issues in Gamifying DeFi

Market Volatility and its Impact on P2E Games

The volatile nature of cryptocurrency markets poses a significant risk to Play-to-Earn games. The value of in-game assets, tokens, or NFTs can fluctuate wildly based on the broader market, affecting both players’ earnings and the sustainability of the game economy.

For example, if the price of the underlying tokens (such as Aave in Aavegotchi) drops significantly, players could experience losses, and the overall game ecosystem may face instability. This volatility can deter players from entering the space or discourage long-term engagement with the platform.

Regulatory and Legal Concerns with Blending Gaming and Finance

The convergence of gaming and decentralized finance raises concerns regarding regulations, particularly in regions where cryptocurrency and gaming laws are still evolving. Governments may view P2E models as a form of financial investment, subjecting them to securities or tax laws.

For example, if a game is considered an investment vehicle rather than purely entertainment, it may face strict regulatory oversight. This could restrict the ability of DeFi projects to operate in certain jurisdictions or introduce compliance hurdles that hinder their growth and innovation. The uncertainty surrounding the regulatory environment could cause delays and complications in adopting these models.

Security Risks in Smart Contracts and Decentralized Platforms

Security remains one of the most pressing concerns when it comes to DeFi and gamified systems. As DeFi platforms are built on smart contracts, they are susceptible to vulnerabilities, hacks, and exploits. Even minor flaws in the code can result in significant financial losses for users.

For instance, in the case of Aavegotchi or other P2E DeFi projects, if smart contracts are not properly audited, malicious actors could potentially exploit loopholes, draining funds from users or compromising the platform's integrity. Additionally, decentralized platforms are more difficult to regulate and monitor, increasing the likelihood of fraudulent activities or scams targeting unsuspecting players.

By addressing these issues proactively, DeFi platforms integrating P2E mechanics can increase their trustworthiness and stability, ensuring a sustainable and secure environment for users.

Looking Ahead: The Evolution of Gamified DeFi

Emerging Trends in DeFi Gamification

As the DeFi space continues to evolve, new trends in gamification are beginning to take shape. One of the key developments is the integration of cross-platform rewards, where players can earn tokens or assets that are usable across different games or DeFi platforms. This creates a more interconnected ecosystem, increasing the value of in-game assets and offering players more flexibility.

Another emerging trend is the deeper integration of NFTs into DeFi platforms. Beyond being used as collectibles, NFTs can serve as collateral, grant special privileges, or unlock exclusive rewards, adding a layer of customization and personal investment to the gamified DeFi experience.

Gamification Driving Mainstream Adoption of DeFi

The gamification of DeFi has the potential to appeal to a broader audience, including those who may not be familiar with traditional finance or blockchain technology. By blending the excitement of gaming with the benefits of decentralized finance, platforms can lower the barrier to entry, making DeFi more accessible and engaging.

For example, Play-to-Earn models allow users to earn cryptocurrency by simply participating in the ecosystem, creating a gateway for individuals who might not initially be interested in financial markets to get involved. As these games and platforms become more user-friendly and fun, mainstream adoption of DeFi could become a reality, especially among younger audiences and gamers.

Potential for Traditional Finance to Adopt Gamified Elements

The success of gamified DeFi projects might inspire traditional finance institutions to explore similar approaches in their own services. For instance, banks and investment platforms could introduce gamified incentives like rewards programs, virtual challenges, or staking models to engage customers in managing their investments or savings.

Additionally, loyalty rewards or gamified savings programs could be implemented to encourage customers to interact more frequently with financial products, making the experience of managing money more interactive and enjoyable. If gamified elements find success in decentralized systems, they may soon find their way into conventional financial services as well.

As these trends continue to unfold, gamified DeFi has the potential to reshape both the gaming industry and the traditional financial sector, creating a more inclusive, dynamic, and engaging financial ecosystem.

Conclusion

Gamification is rapidly becoming a transformative force in the decentralized finance (DeFi) space, with P2E mechanics at the forefront of this revolution. The integration of gaming elements into DeFi not only adds excitement but also offers a new way for users to interact with financial systems, making these platforms more accessible and engaging for a wider audience. As more users discover the potential of earning passive income and gaining exposure to decentralized platforms, the appeal of gamified DeFi continues to grow.

While the integration of P2E mechanics brings numerous benefits, such as enhanced user engagement and new financial opportunities, it also presents challenges. Market volatility, regulatory concerns, and security risks remain significant hurdles that need to be addressed for the sector to achieve sustainable growth. The blending of gaming and finance requires careful consideration of these risks, ensuring that platforms remain secure and compliant while continuing to offer innovative experiences.

Looking ahead, the evolution of gamified DeFi holds immense potential to shape the future of both finance and gaming. By making decentralized finance more engaging, accessible, and rewarding, gamification could drive mainstream adoption and create a new, more interactive way for individuals to manage and grow their wealth. As these trends gain traction, traditional financial sectors may also find opportunities to incorporate gamified elements, further blurring the lines between gaming, finance, and technology. The journey of gamified DeFi is just beginning, and its impact on the global financial landscape could be profound.